Alts are bid heavily again this week. And all eyes are on NFP and Silvergate Bank.

Week over week performance:

- BTCUSD: 22,402, -4.22%

- ETHUSD: 1,568, -3.46%

- US02Y: 4.87%, +8 pcts

- DXY: 104.3, -0.33%

- GOLD (USD/OZ): 1,846, +2.09%

- NDX: 12,302, +1.77%

- VIX: 18.64, -11.57%

- VVIX: 76.41, -5.17%

On the macro side:

This week, all attention is on the February Non-Farm Payrolls (NFP) report, which will be released on Friday at 8:30 am ET. The forecast sees the addition of 200,000 new jobs, but if this number is higher than anticipated, it will most likely lead to a significant market downturn.

Indeed, a hotter than expected labour market will push the Fed to opt for a 50 bps hike – instead of a 25 bps hike – at the next FOMC meeting.

On the crypto side:

SILVERGATE, NYSE:SI 5.41$ (-62% WoW)

During Friday’s Asia session, digital assets experienced a sudden decrease.

In my opinion, this was likely due to a forceful seller triggered by the recent Silvergate announcements. Silvergate has failed to report their 10-K form, potentially as a result of not meeting capital requirements.

Although this is speculative, it is possible that the drop in bitcoin and other digital assets is a consequence of a forced liquidation of crypto-backed collateralised loans.

Then, I suspect that the SEC is currently gathering all necessary documents before they come knocking on Silvergate’s door in La Jolla.

All things considered, Silvergate Bank continues being one of the biggest crypto-specific risks.

I do not believe that these risks have been fully factored into the pricing of bitcoin and other digital assets.

Bitcoin

The key support level continues to be between $21.5k and $22k. If we break through this level, the next support level is expected to be around $18.5k at post-FTX levels.

On the upside, the short-term resistance level is $22.5k, and if we break through that, it could go up to $24k.

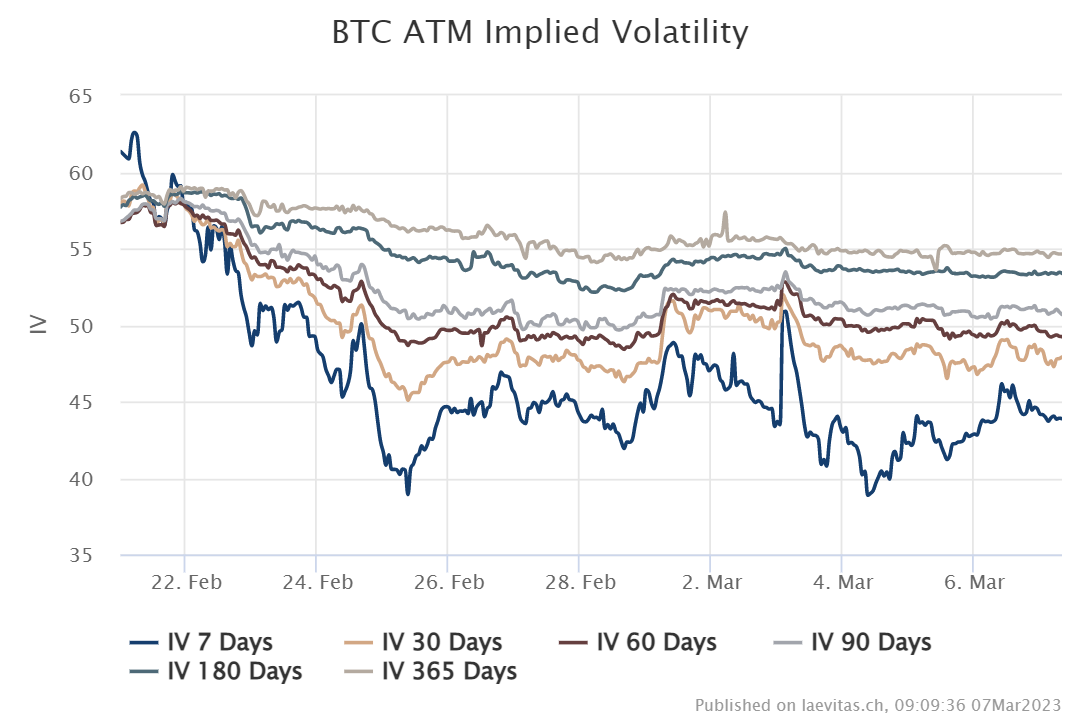

In terms of derivatives: the volatilities have been softening week over week, which sets up a favourable scenario for a calendar spread ahead of next week’s potential volatile events.

An interesting trade is financing short-term gamma by selling 30-day OTM options.

Chart 2: BTC ATM Implied Volatility

The long-term skews (the difference between implied volatility of put and call options) have turned negative, which is a positive sign for the near-future spot prices.

OTM long-term call options have been bid in particular, and a rise to $40k by September-December 2023 is not that unrealistic.

Chart 3: BTC Skew (put minus call)

Chart 3: BTC Skew (put minus call)

Read more News here