Trust nothing and verify everything…

The “post” FTX world is best summarised with the saying “trust nothing, verify everything,” as the entire industry is testing the trustworthiness of many players. Only those who did not play around and enhanced optimal risk management practices will survive.

I am studying and keeping a close eye on:

1. Genesis, Grayscale, and Digital Currency Group (DCG)

2. Tether

3. Coinbase

1. The Genesis Case

The most interesting story here is not just about the likelihood of a Genesis bankruptcy, but rather the implications it would have on Grayscale in the event of Genesis filing for Chapter 11. Here is a good article to read on this topic: https://datafinnovation.medium.com/3ac-dcg-amazing-coincidences-c14eec941c06

What happened for a long time – when GBTC was trading at a premium – was the following:

1. Funds borrowed BTC from Genesis as a lender pledging collateral

2. Funds then passed those BTC on to Genesis as an Authorised Participant to create GBTC shares

3. Genesis duly locked the BTC in the trust via Grayscale and returned shares

4. Then the funds might have decided to sell the GBTC shares on the open market at a premium or – the more likely case – to pledge these shares back to Genesis for a USD loan; if the premium was large enough, this loan/profit was larger than the BTC initially borrowed

5. Begin again at the top with Number 1

There are two implications/considerations involved:

1. The circularity (it artificially influenced the market by making GBTC more attractive and pumping the spot price), and it turbo-leveraged many hedge funds (i.e. 3AC)

2. As long as the GBTC is trading at a discount and/or the spread widens, many borrowers will fail in paying back the loans: this hurts Genesis, Greyscale, and more generally, DCG

As observed by QCP https://qcpcapital.medium.com/market-update-8-jul-d85a398f6849, the GBTC premium was one of the reasons for the bull market, as new in-kind capital was added to the market. Now that GBTC is trading at a discount, no new-capital is being added to the market. As long as redemptions continue being suspended, there is no mechanism for GBTC to go to par.

It is now known that most of Genesis’s lending book depends on Grayscale’s trusts.

So, what can DCG do to bring GBTC back at a premium and save Genesis?

a. Returning capital to shareholders through buybacks of GBTC

b. Flipping the trust into an ETF, but this is out of their control (now it has become clear as to why they pushed for the conversion)

The GBTC is now backed by 635k BTC, so liquidating them is not going to be easy, and it will very likely hurt the market.

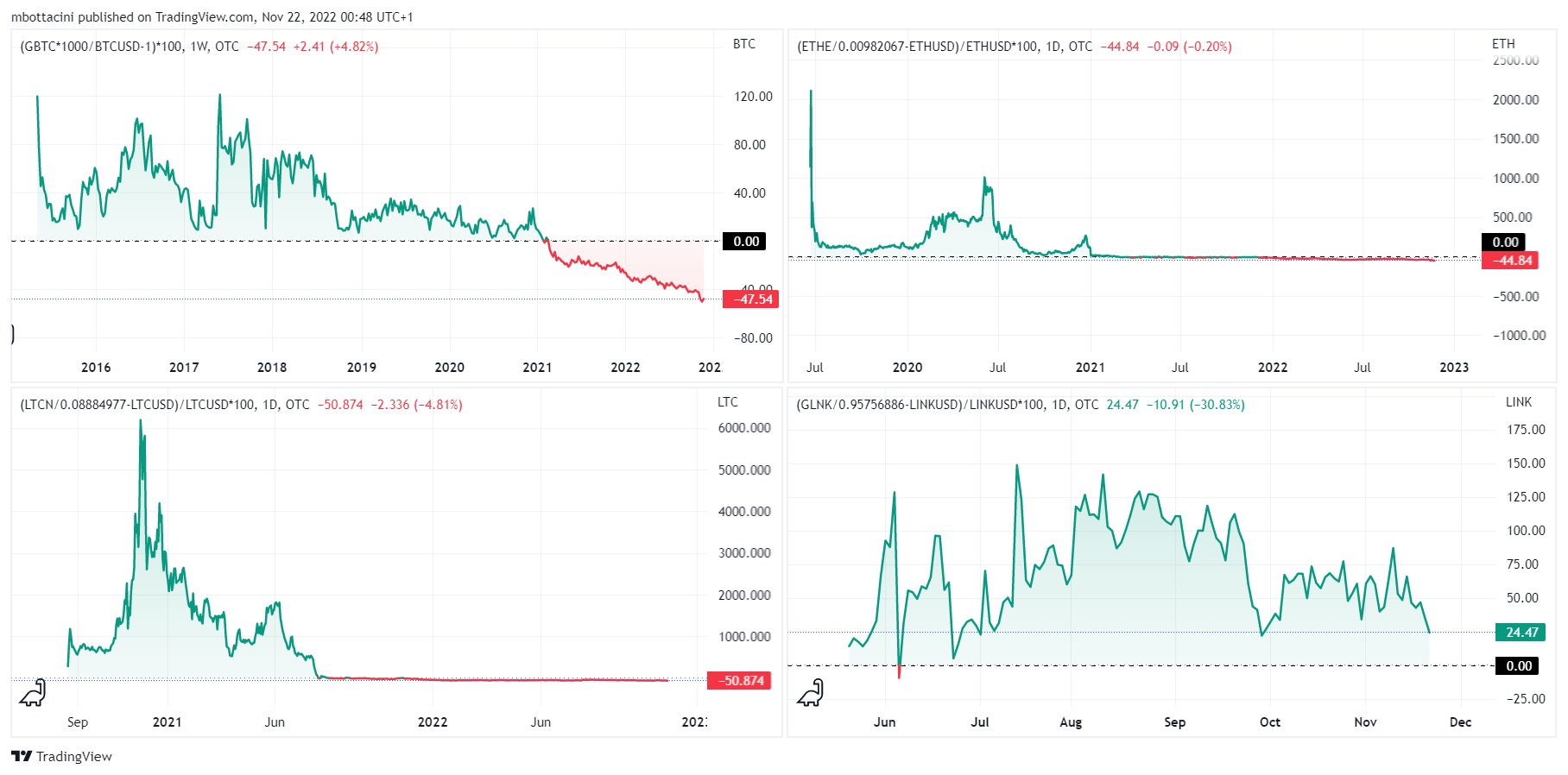

In the chart below, you can see the premium (discount) of the main Grayscale trusts (GBTC, ETHE, LTCN, and GLNK).

2. Tether: is it 1:1?

Tether has always been one major point of discussion in crypto on account of its non-transparent history. And there are still today ongoing discussions regarding the quality of its reserves.

Have a look at the Tether Assurance Consolidated Reserves Report from September 30, 2022

(Href: https://assets.ctfassets.net/vyse88cgwfbl/1Xfu4398CIoMiuKjPhvnHM/6d1608c90bb775d2d432b7b24264da28/ESO.02_Std_ISAE_3000R_Opinion_30-9-2022_RC134792022BD0548.pdf )

We appreciate the following:

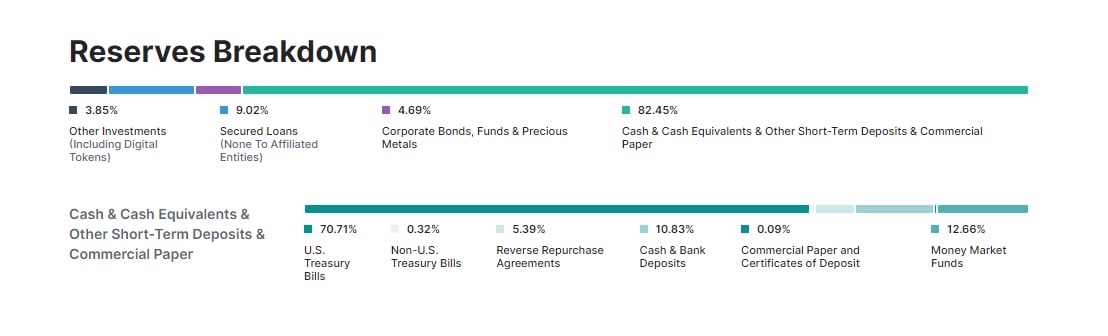

– 82.45%: cash & cash equivalents & Other short-term Deposits & Commercial Paper (maturity <90 days)

– 4.69% Corporate bonds, Funds & Precious Metals

– 9.02% Secured Loans

– 3.85% Other investments

We can assume that cash equivalents andcCorporate bonds overall generated a net positive (representing 87.19% of the reserves +/- 2%).

Then again, for secured loans we can assume that these were made to crypto companies or similar, thus a 40% probability of default might be reasonable.

For “other investments” it is likely that these are an investment in BTC/ETH/AVAX, etc., which are down 60% YTD.

We can then assume that these two are likely now worth 6.95% instead of 12.87%.

Therefore, USDT might have a current status of 0.96:1.

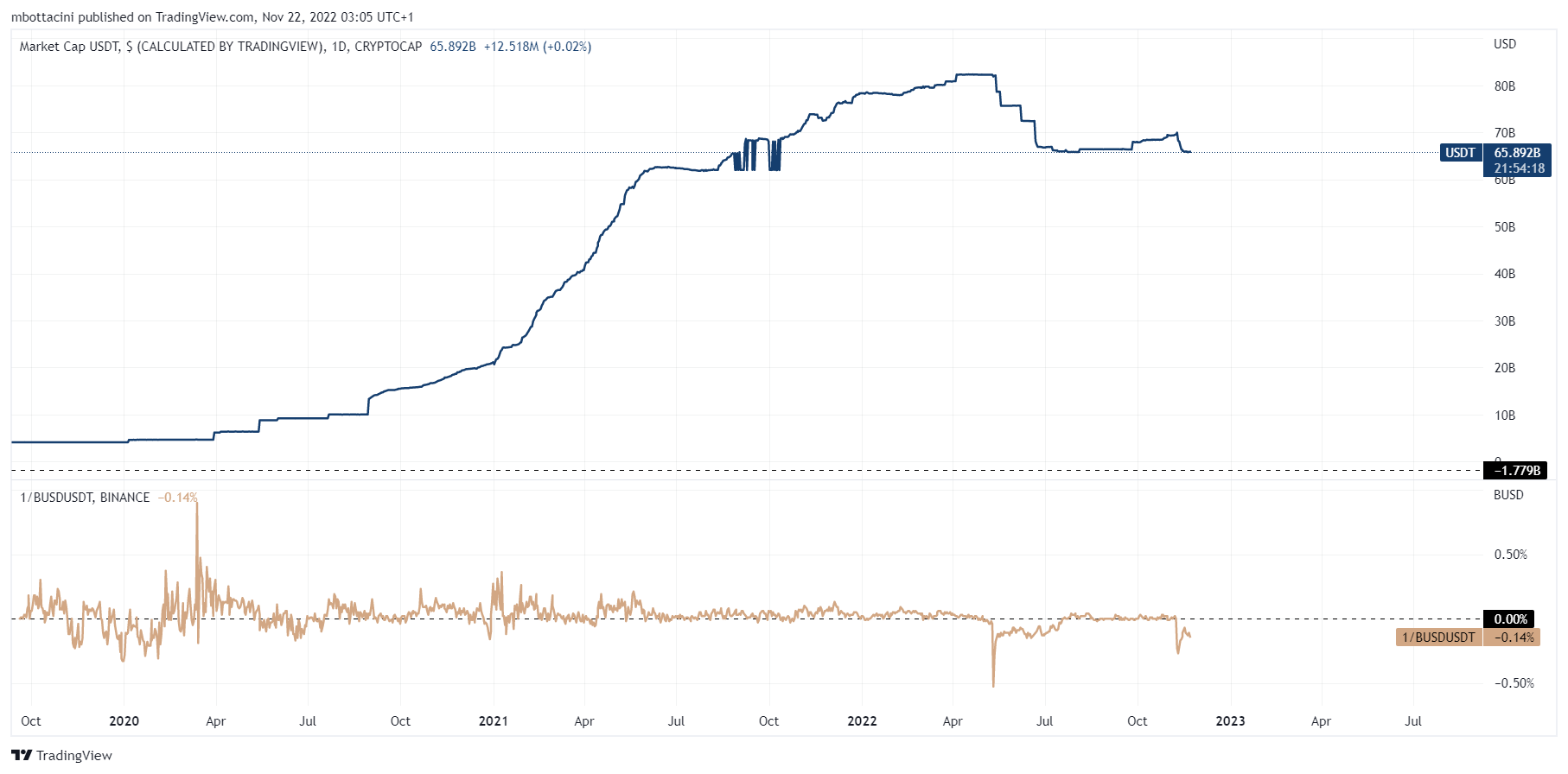

USDT market cap is currently $65B, and it is by far the most popular stablecoin used for trading spot and crypto derivatives (especially Delta One products).

On Coinbase, USDT is trading against USD at 0.9986 and similarly on Binance against BUSD.

What are the consequences if a new scandal hits Tether?

Due to the Tether process of minting/redemption, and the fact that not 100% of the reserves are held in bank deposits as cash equivalents, Tether will be unable to process an excessive redemption demand. If there is a hole in the balance sheet again, it is very likely that Tether will simply say that they are able to process $N billion per week, and that everything is fine.

In terms of price: we will see not only USDT/USD start de-pegging, but it will create a great deal of turmoil in both the DeFi pools and in the derivatives space as many Perpetuals and Term-Futures are margined in USDT (i.e. USDT down, Futures up).

It is very likely that Binance – the big brother – will impede some buy/sell orders to avoid the de-pegging (the same way it did with Terra/Luna).

Also, now that FTX is no longer active, it is going to be harder for derivatives/margin traders to hedge the USDT exposure, which means that we might see an increase in volatility as a result of liquidations /an unwinding.

3. Coinbase: far from the bankruptcy?

Coinbase has suffered a great deal. But whether it now seems to be better positioned or not, its shares keep on plunging ($COIN: $41.23, -83% YTD), and its corporate bond expiring in January 2031 is now trading at USD 51 (face value: USD 100) with a coupon rate of 3.625%, implying a yield of 13.09%.

As investors will re-assess counterparty risk, we might see a bouncing back on the yield as some players might buy the bond as an insurance. Therefore, even if a higher yield implied a higher risk (or probability of default), bonds typically have some recovery rate (40-60%) even in the event of bankruptcy. Also, a drop in yield will definitely lead to a breather in the crypto space.

Here is the link to the bond: https://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C996374&symbol=COIN5259271

And now, let us address the price:

I am still biased and believe we will see further downside, but I keep seeing BTC outperforming ALTS.

I would not be surprised to see BTC trading in the 10k-13k range.

On the macro side:

The dollar ride might end soon. Then, the decline in the dollar value (i.e. DXY) is going to be fast, and for sure it is going to be faster on the way down then it was on the way up.

This will certainly help risk assets, but it is not going to be enough for crypto.