Bitcoin

$64,459.72

BTC 5.32%

Ethereum

$3,076.99

ETH 3.41%

Litecoin

$80.42

LTC 1.30%

It is unlikely that this week will see much change, and any volatility move is going to be to the downside. Volatility for risky assets remains, as the USD rally continues.

On the macro side: Last week, the NFP numbers came in (see full report here):

– Unemployment rose to 3.7% from 3.5%

– BUT participation rose to 62.4% from 62.1%

– 315k payroll jobs were added (consider 150k are maintenance)

As rate sensitive sectors, e.g. construction, keep growing, the Fed will continue – no matter what to hike until things break, regardless of if this is inflation or the economy.

I do not see any reason why the supply shock should evaporate any time soon (think of EU commodity issues, etc.).

Prices will keep rising unless there is a demand crush.

Speaking in macro terms, I keep seeing large downside potential in both the short and medium term.

Looking ahead, this week’s major events are the following:

1. Fed speeches will be held from Wednesday to Friday. Powell will speak on Thursday.

2. ECB rate decision will be on Thursday (forecast: 75bps).

On the crypto side:

– Crypto Total Market Cap: $967B (-0.41% WoW)

– $BTC: 19,750 $ (-2.5% WoW)

– $ETH: 1,640 $ (+5.69% WoW)

– $SOL: 32.57 $ (+0.46% WoW)

Correlation among digital assets continues being high, with high betas outperforming as risk-on appetite from this summer’s lows is still in.

I expect this kind of behaviour to remain ongoing as we move closer to the Merge.

Also, correlation with TradFi risky assets remains high, as BTC 30d correlation with SPX is 0.56 and 0.58 with NDX.

The narrative is the following: BTC is driven by macros with other cryptocurrencies delivering beta performances.

ETH still has its own narrative (the Bellatrix update is scheduled for Sept 6th), and it is still driving the DeFi and L2s space, but it is still difficult to see it surviving the macro scenario.

My play remains the same: stay long on alts “financed”/hedged by short BTC. With betas unchanged this still pays off in this low-volatility scenario.

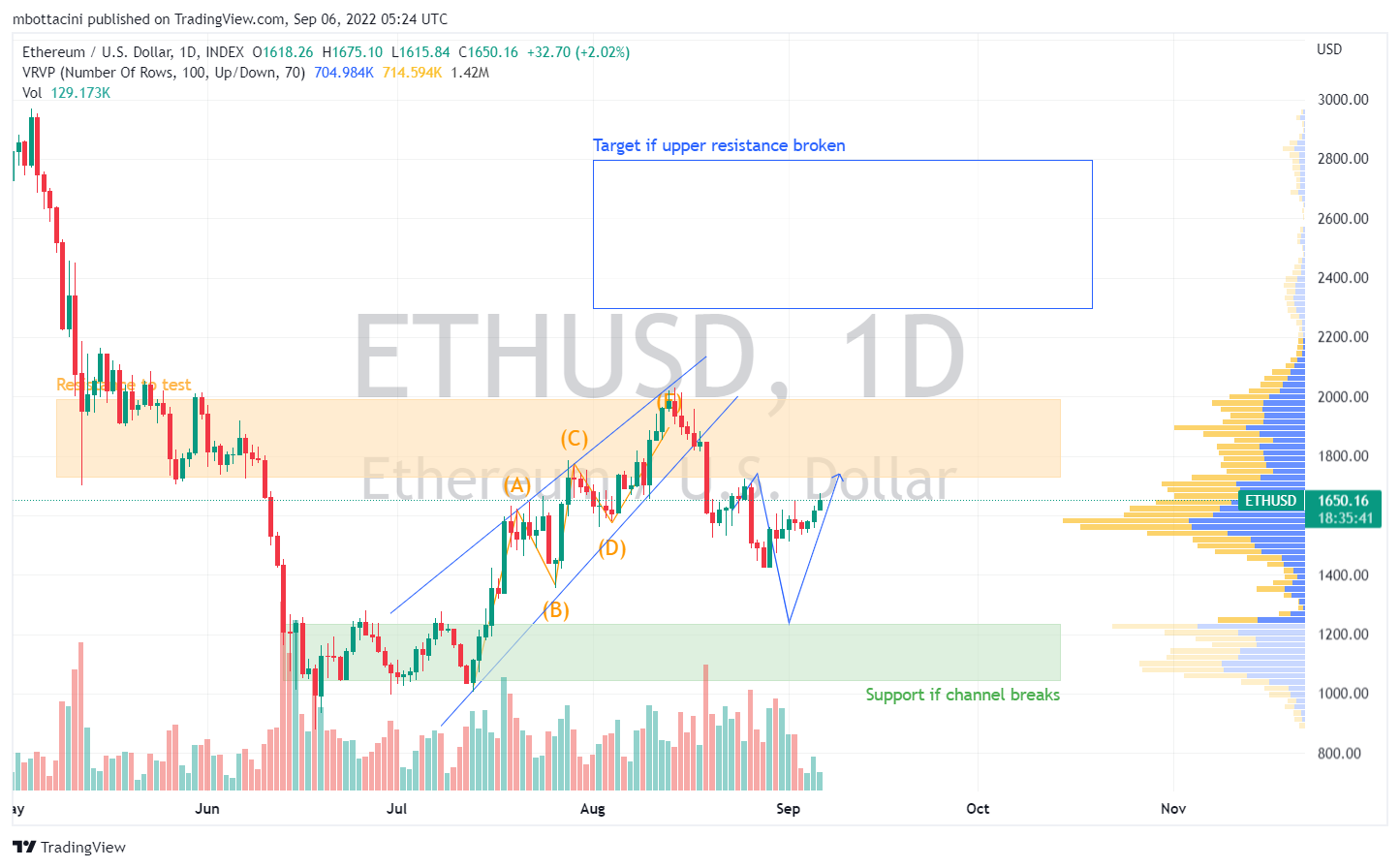

Looking at the charts:

– $BTC is consolidating at around $20k; this is most likely the resistance, not the support now.

– $ETH is approaching the $1,750 resistance. A break will bring us towards $2,000 first and then to $2,400. If $ETH is unable to hold higher prices, $1,200 is the support.