Download the House View PDF here.

1. Crypto Market Insights

November was quite an eventful month, including everything from a potential pivot in the macro environment to the collapse of FTX, one of the largest crypto exchanges. However, despite the drop in market sentiment, there is one silver lining: the FTX collapse was more a collapse of poor enterprise management (and potentially also fraud) than it was a collapse of crypto itself.

By Friedrich Herzog

FTX broke the silence

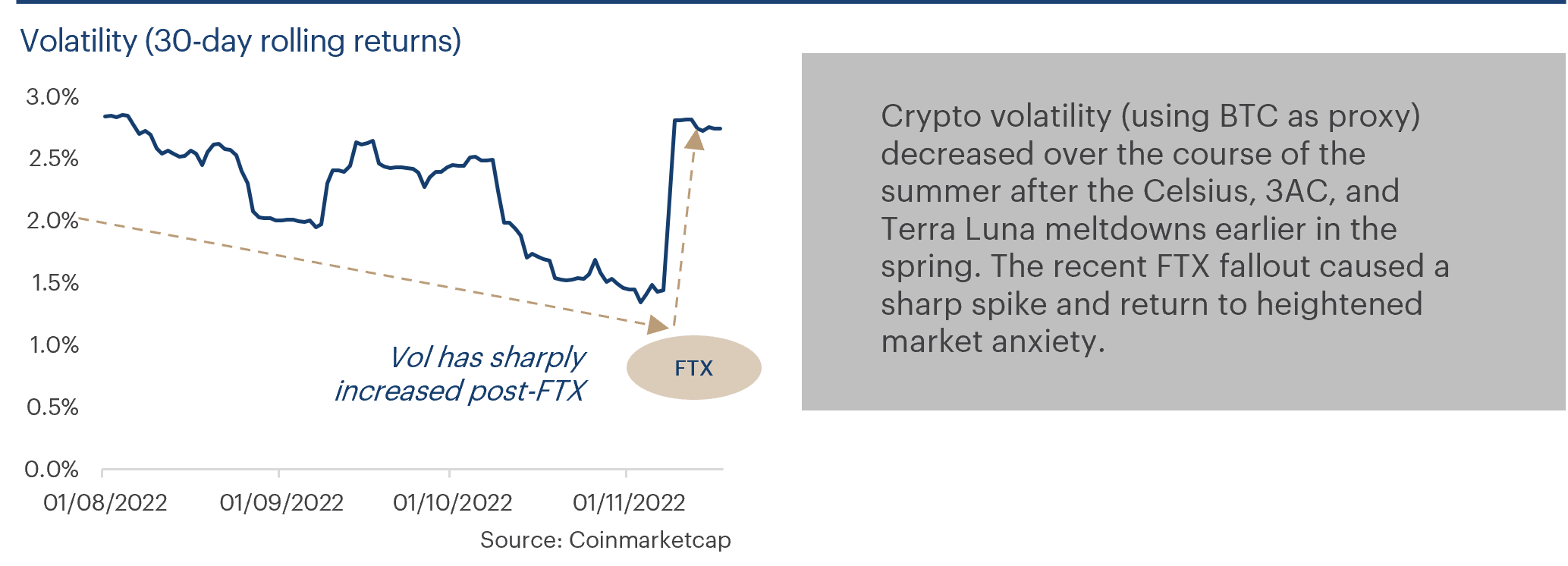

Ever since the fallout of Celsius, 3AC, and Terra Luna, bitcoin has been trading sideways, causing realised volatility to fall to its lowest levels in recent history. Smaller cap tokens, however, posted significant gains over the same time period. The consensus in the market was that the most over-leveraged players had been flushed out with the likes of Luna, 3AC, and Celsius collapsing earlier in the year, and that going forward crypto performance would be dominated once again by macro risks. This idea was turned on its head with the unexpected collapse of FTX and the subsequent contagion in the market. Below we provide a brief timeline of events for context:

- 2 Nov 2022: CoinDesk publishes a report about the leaked balance sheet of Alameda Research, which indicates that the majority of the assets are FTT tokens issued by FTX itself, and thereby revealing how intertwined the businesses are.

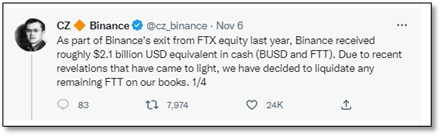

- 6 Nov 2022: Binance CEO, Changpeng “CZ” Zhao, says that due to “some revelations” and for the purposes of “risk management”, Binance would sell their FTT tokens on the open market.

- Given the low liquidity of FTT, this causes market stress in anticipation of a potential liquidity crunch at Alameda, which would force Alameda to also sell off some of the other assets, including large positions in Solana.

- 8 Nov 2022: After the initial phase of denial, FTX halts withdrawals of customer funds, and admits to liquidity problems, while assuring customers that “assets are fine”, and insinuating that it is merely facing a short-term liquidity gap due to the magnitude and speed of withdrawals. Binance announces the signing of a Letter of Intent to purchase FTX in order to provide a liquidity backstop. The market (very) briefly partially recovers from its lows on the back of the news, but it remains under stress with relatively high intraday volatility.

- 9 Nov 2022: Confirming prior rumours, Binance cancels the deal given concerns about the magnitude of the liquidity gap as well as concerns about litigation from US authorities and the effects that could have post-acquisition.

- 10 Nov 2022: Alameda officially winds down trading while FTX searches for potential liquidity providers in the market. Sam Bankman-Fried (CEO of FTX) announces a “deal” with TRON founder Justin Sun, which is designed to allow TRX holders on FTX to withdraw their tokens as well as other assets linked to Justin Sun. This deal is highly criticised, however, mainly due to the conflicts of interest created between Justin Sun and FTX customers. In fact, prices of TRX on the FTX platform traded at significant premiums relative to those on other exchanges, meaning that FTX customers had to buy TRX at inflated prices, to then sell them at low prices once funds had been moved outside. Who takes the other side of that trade? I have a hunch…

- 11 Nov 2022: FTX files for bankruptcy. The bankruptcy documents reveal a network of over 130 affiliated corporate entities scattered across the globe. The veteran bankruptcy lawyer who also ran Enron post-bankruptcy, John J Ray III, takes over as interim CEO of the FTX Group.

- 12 Nov 2022: Just when everyone thinks “it’s over” and assets remain frozen due to the initiated bankruptcy proceedings, the real action starts: FTX allegedly gets hacked and large amounts of funds are withdrawn from the exchange’s account.

- 13 Nov 2022: Sam Bankman-Fried is questioned by Bahamian police and regulators but released and allegedly remains in the Bahamas.

What the “hack” happened after the bankruptcy filing?

Over the weekend of November 12th, on-chain analytics firm Elliptic reported suspicious activity on FTX’s wallets, indicating that funds were being moved into anonymous wallets outside of FTX. While this was officially touted as a hack, it initially seemed more likely to be insiders who were relatively “inexperienced” (or careless) in DeFi, as the proceeds were subsequently funnelled through centralised exchanges such as Kraken, which has KYC. In fact, Kraken’s CTO confirmed in a tweet that they “know the identity of the person”.

In the meantime, rumours are circulating that the Bahamian authorities may be behind the movement of funds. According to online revelations, authorities have instructed FTX to move funds into government wallets “for safeguarding”. In the meantime, on-chain analysts are continuously providing further insights and tracking down the breadcrumbs left behind by the “hackers”.

This highlights one of the promises of blockchain technology: all transactions are public and permanent, which means that with the right skill set, blockchain experts are likely to be able to corroborate sufficient evidence to help identify the recipients as well as any involved parties. (Here is another example: the historic seizure of USD 3.36bn bitcoin by US authorities earlier in the month (unrelated to FTX), from a fraud case on the dark net over ten years ago!)

Contagion

The biggest fear lingering in the markets after the FTX collapse is potential contagion. In the initial aftermath, significant amounts of capital flowed out of exchanges, putting additional liquidity pressure on many centralised institutions. For several days, there were concerns that Crypto.com, for example, would face potential liquidity issues. Genesis, a crypto lending platform, halted withdrawals and is rumored to have a liquidity hole of up to 1 bn. This could negatively impact DCG, the parent company of both Genesis and Grayscale. BlockFi, another lending platform was already stressed after the Terra Luna crash earlier this year when it was saved by the now bankrupt FTX and has since filed for chapter 11 bankruptcy protection in the US.

Many exchanges attempted to calm the markets by providing “proof-of-reserves” either via posting their official wallet addresses and thereby attempting to ensure customers of their balances, or by promising official audits and issuing a so-called “Merkle tree proof-of-reserve”. The concept of a Merkle tree proof-of-reserve is an attempt to provide cryptographic evidence of an exchange’s reserves. It is, however, not a panacea to the problem because there are limitations and drawbacks. It still requires an auditor, and it relies on their integrity; it also does not provide a complete picture of actual solvency. Having said that, though, there is an argument to be made that the industry will focus on finding more innovative solutions to the “trust” problem with centralised entities, using blockchain technology’s unique properties. If executed well, this could demonstrate another avenue of true innovation. In the traditional world, complacency and trust in companies’ official records have always been at the core of the biggest examples of fraud in the system. Examples such as Bernie Madoff and Enron have proven that what happened with FTX is not unique to crypto! In fact, the FTX collapse is “just” a failure of an overly leveraged centralised entity with poor management. At the core, it has nothing to do with cryptocurrencies or blockchain technology per se.

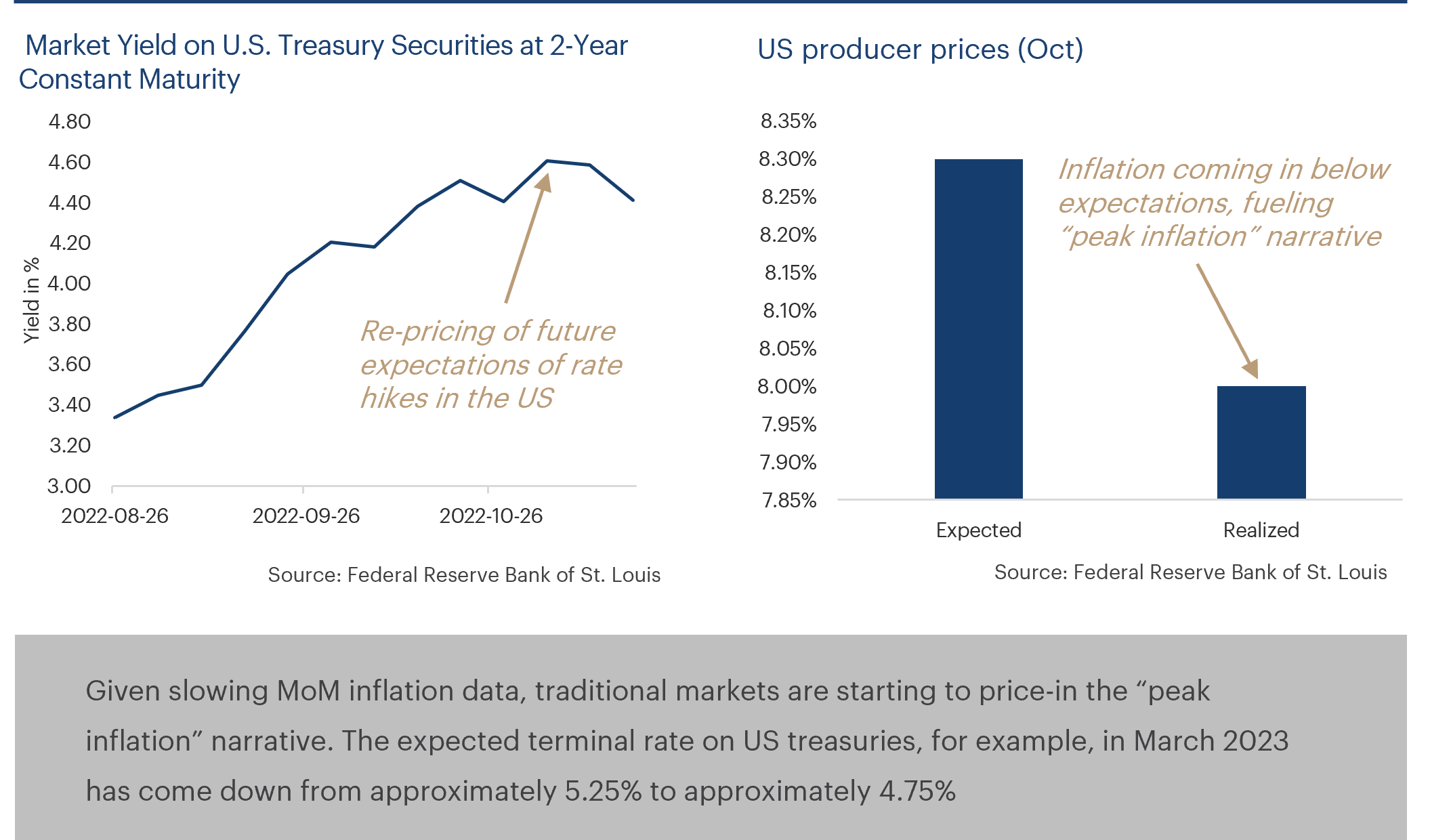

Macro did not matter

While FTX was rocking crypto markets, equities and bonds rallied after the latest CPI print, which missed expectations to the downside, fuelling the “peak inflation” narrative, which is fundamentally bullish for risk assets. Consequently, the ECB is now expected to slow the magnitude of rate hikes, with markets expecting a 50 bps hike at its next meeting, and voices of proponents for larger hikes slowly fading. US Treasury markets have also started to price-in a slowdown, as can be seen on the chart below, with the future Fed funds rates falling relative to a month ago.

Outlook

Given the FTX collapse and the uncertain path forward, our expectation is that we will likely remain range-bound in the near-term. That said, assuming no further major fallout occurs, we are optimistic that crypto will recover in the medium-term as leverage in the system is getting purged. If we look at the futures basis, for example, which is a proxy for systemic leverage, we are at historically low levels, even dipping into negative territory now! This is likely setting the stage for a promising supply-demand dynamic once the dust settles. Once demand returns, we believe it will be met by tight supply, which in turn should be a positive catalyst. For example, stablecoin dominance has increased to 18% in the past few days, which could be an indication that a significant portion of the crypto market cap is just waiting for the storm to pass before being re-deployed.

Paul Tudor Jones famously called bitcoin the “fastest horse” in the race, and we strongly believe this will remain the case for crypto in general. But now more than ever, investing in robust strategies that are well diversified and professionally managed will be the key to weather this market environment over the medium to long-term.

2. An Intro to Web 3.0

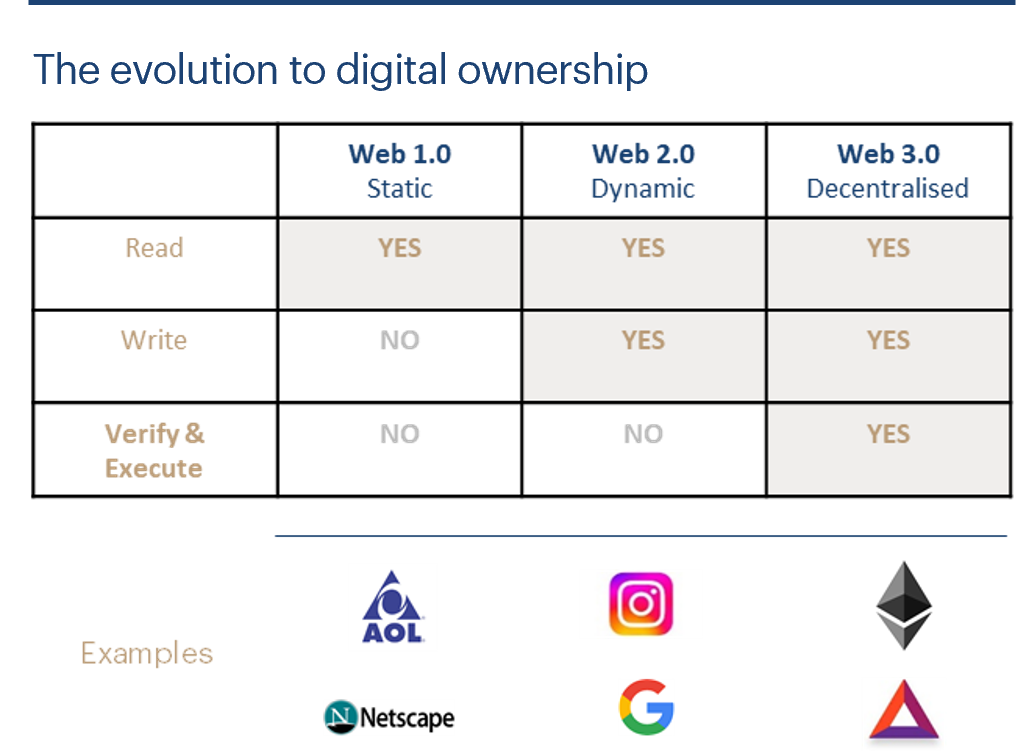

Web 3.0 is a term that emerged in the 2000s, but it has only gained traction in the last few years. With the surge of bitcoin and blockchain, Web 3.0 is used to describe the transformation of the web towards decentralisation and user ownership. How could Web 3.0 change our existing interactions with the web? How does blockchain fit into the picture?

By Felipe Baptista Giesbrecht

Before we dive deeper into Web 3.0, let us briefly look at how the web developed over time.

Web 1.0: the read web (1999-2004)

Originally, the web was envisioned as an open and decentralised architecture that allowed for global information sharing. During the Web 1.0 period, users would mostly consume content from static webpages and user interaction was limited.

Web 2.0: the read-write web (2004-now)

In the early 2000s, the web started evolving towards user interaction. Forums and social media platforms emerged. Users started being able to share content and communicate openly with each other. With the rise of smartphones, Web 2.0 experienced exponential growth, which resulted in global interaction taking off. Web 2.0 has evolved a great deal in terms of user interface and interaction, but it still has challenges to overcome.

One of them is the lack of ownership users have with respect to their data and content.

Most of the content users produce and upload are on platforms owned by near-monopolies on the web. Another one is economics: a significant share of the advertising-generated profit on websites is held by the same handful of companies, even though the traffic is only due to user generated content.

Let us clarify this by means of an example, i.e., why do many of us have five messenger apps on our phones? Because Telegram does not allow a message to be sent to WhatsApp, for example. The channel controls the access to the protocol as well as all of the underlying data and uses that data for monetisation purposes (see image below). Bitcoin, however, is different: all of the protocol data is open and accessible by anyone, and anyone can build an app that is interoperable with other apps (i.e., one can send bitcoin from a Coinbase wallet to a Trust Wallet).

Web 3.0, the read-write-own web

Web 3.0 is a vision of the third iteration of the web. At its core, it envisions a more decentralised web that introduces new user ownership and economic incentives. Everything incentivises users to earn; e.g., the internet browser Brave distributes ad revenues to users directly into their wallet instead of giving it to Google.

How could this vision come true?

The invention bitcoin brought, created uniqueness in a digital form without trust as a central intermediary for verification. For example, if a user takes a picture with their phone and sends it to someone, there are then two copies of this image (= Web 2.0). Data can be copied endlessly, and therefore the value goes to 0. But bitcoin changed this, as it managed to create unique data that could not be copied. This concept enables us to express value in a digital form for virtually anything. Whether it is land in the metaverse or a token of ownership of a real painting. Hence, blockchain and digital assets play a key role in turning the vision of a decentralised Web 3.0 into reality.

Web 2.0 vs. Web 3.0 metaverse

“The metaverse” does not exist yet – a number of virtual worlds calling themselves metaverses have been created (i.e., decentraland, horizon, and sandbox). The vision of “the metaverse” would connect several virtual worlds so interaction can take place. Therefore, we need a protocol such as TCIP, which enables different servers to communicate with each other through a widely accepted standard. The same way that every webpage can be rendered by a single browser.

At the moment, all “metaverses” only exist by themselves and are not able to talk to other virtual worlds. Let us look at some practical examples. Versions of digital worlds exist since the late 1990s. In the 2000s, many of the widely known Web 2.0 metaverse titles known today started appearing:

- 2003: “Second Life”: a 3D online platform was created, where users were able to create an avatar and interact with other users in a digital world

- 2003: the space-based virtual world “EVE Online” launched; to date, it is one of the most interesting worlds in terms of economic complexity and has been a research topic of multiple academic papers

- 2004: the infamous multiplayer online role-playing game “World of Warcraft” launched, where users can create avatars to explore a fantastic virtual world

- 2006: the online game platform and game creation system “Roblox” launched; in August of 2020 it had 164 million active users, including more than half of all American children under the age of 16

- 2017: Epic games launched the free-to-play battle royal game Fortnite, which became a cultural phenomenon; global artists held digital concerts in Fortnite, with one concert having over 12 million people attending online with their avatars

What do these early metaverse examples have in common? Users spend a significant amount of time in their lives investing in their digital identities inside of these worlds. They accumulate assets, create content, and cultivate social relationships. The users, however, do not in fact own any of these hard-earned digital assets. If the responsible company for the respective virtual world were to shut down their servers, everything created in this alternative world would simply be gone. This was the case for innumerable gaming metaverse examples in Web 2.0: Star Wars Galaxies, Warhammer Online, Little Big Planet, and many others.

How could the metaverse look like in Web 3.0? Let us assume that the economics of a specific virtual world works based on cryptocurrencies and non-fungible tokens. Users could connect their blockchain wallets when entering that virtual world. All the assets stored in the connected blockchain wallet could be verified and, if compatible, take a digital form or give specific rights. Additionally, assets and digital money earned in that world would automatically be transferred to that wallet. Should the virtual world ever cease to exist, the wallet would still be a proof of ownership of these assets. This has the potential to enable an interoperable metaverse, which would make it possible for users to take assets over to other virtual worlds.

Additional use cases

The above concept of ownership can also be applied in other areas of the internet. Brands and consumers can be brought closer together through the ownership of digital property. Imagine brands creating digital assets that enable participation in closed events, drive involvement in brand decisions or give collaboration incentives. All of this can be leveraged to create further community building around the company. Another example is the NFT creator royalty concept, from which artists and companies can greatly benefit. If desired, NFTs sold on a secondary market can include royalties to the author/creator of the NFT. Every time a secondary sale occurs, royalties are paid automatically to the author after the transaction occurs.

Traction

In November 2022, Instagram started testing a digital collectibles feature: content creators will be able to create and showcase non-fungible tokens on the platform, starting with assets from the Polygon blockchain. These NFTs can then be sold to fans on and off Instagram through blockchain wallets. Social media platform Twitter is working on enabling users to use NFTs as profile pictures, and recently announced that in the future users will be able to buy and sell non-fungible tokens through tweets.

A company that has already successfully implemented the concept of avatar ownership is Reddit, a social platform with an average of 430 million monthly users. Since July this year, over 2.5 million wallets were created and used to buy unique avatars, which can be used as profile pictures and enable special effects. Other companies, such as Nike, Adidas, and McLaren, have also started to work with the non-fungible token concept. Goldman Sachs puts it as follows: “…the global internet is in the middle to late innings of the innovation curve of Web 2.0 and the leaders of this wave of internet are now firmly established. In framing the next wave of computing (Web 3.0), we see the potential for dramatic shifts in industry structure…”

3. Trading Desk View

Decentralised and centralised exchange tokens were in focus in November

By David Scheuermann

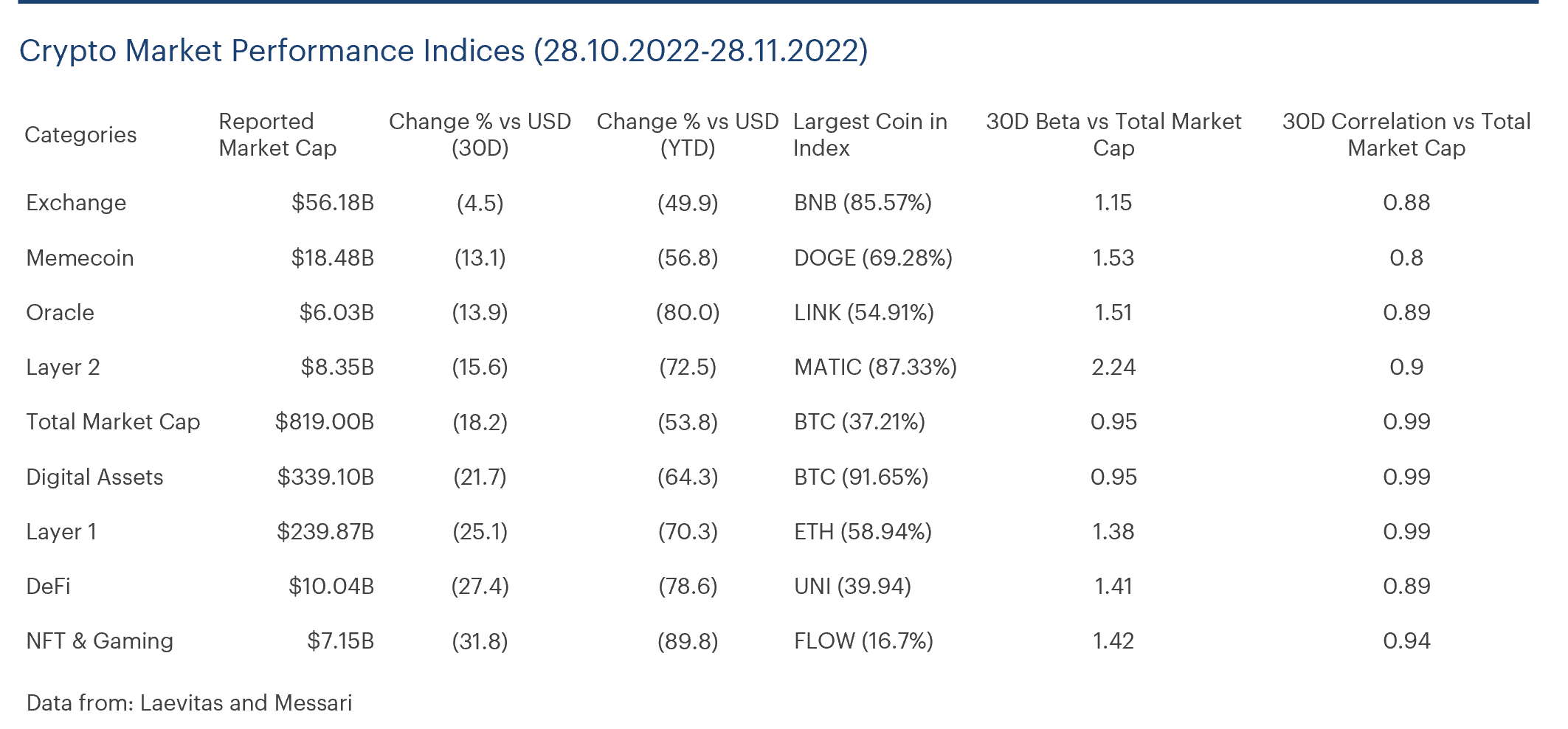

November was a poor month for the crypto market. 18% of the total market cap was lost on the back of the FTX meltdown. And all of the Laevitas indices were negative this month.

The collapse of FTX and FTT sent a shockwave across all exchanges. Exchange insolvency and bankruptcy rumours spread quicker than wildfire. The exchange token index was still the best performer this month. Binance, which was a potential buyer of FTX, has benefited from the downfall of FTX, and will likely solidify its position as the number one exchange in terms of volume, derivatives, and coin offering. The BNB coin not only provides lower trading fees on Binance, but also serves similar purposes on the Binance Smart Chain as ETH does on the Ethereum Chain. BNB lost 3.5%, compared to Crypto.com’s CRO, which lost 44.5%.

OKB, the coin of the OKX exchange, is the only positive constituent of the index, gaining 26% this month. OKX has one of the highest derivatives volumes, and offers 172 perpetuals and 603 futures, which is more than any other exchange by far. The exchange announced in a press release on November 3rd that it will open a hub in Nassau, Bahamas after registering under the Digital Assets and Registered Exchanges (DARE) Act.

DeFi tokens again performed poorly in November. Distrust in centralised exchanges should give decentralised exchanges more attention going forward, especially on a retail level. Volume on the largest decentralised exchange, Uniswap, has already increased by 82% MoM.

DYDX was the best performing token in the DeFi index, losing 3.3%. dYdX is a perpetual exchange and has become attractive to perpetual traders as they look for a new home after FTX disappeared. Trading volume on dYdX reached a six-month high during the fall of FTX. The governance token gives users fee discounts when trading on the exchange. Due to the high supply and a lengthy unlock period, the token has been in a downtrend since being released in September of 2021.

Editorial Board

- Patrick Heusser, Chief Commercial Officer Crypto Finance Group

- Lewin Boehnke, Chief Product Officer Crypto Finance Group

- Stefan Schwitter, Head Asset Management at Crypto Finance (Asset Management) AG

Please reach out for more information, send an email to: assetmanagement@cryptofinance.ch or sales@cryptofinance.ch

All information in this document is provided for general information purposes only and with no warranty or liability for accuracy, completeness, or fitness for a particular purpose. No information provided in this document constitutes or is intended as investment advice. This document is not, and is not intended as, an offer, recommendation, or solicitation to invest in financial instruments including crypto assets. Crypto Finance is a financial group supervised by the Swiss Financial Market Supervisory Authority FINMA on a consolidated basis with Crypto Finance (Brokerage) AG as a securities firm and Crypto Finance (Asset Management) AG as an asset manager for collective investments with the corresponding FINMA licenses . This document and its content including any brand names, logos, designs, and trademarks, and all related rights, are the property of the Crypto Finance Group and Deutsche Börse Group. They may not be reproduced or reused without their prior consent.