Yet

again, the week has been slow and driven by macro headlines. Cryptocurrencies

keep holding up better than TradFi with volatility decreasing, while VIX

breached 32, MOVE is above 148 and DXY is at 113. Looking ahead, we will soon

have the FOMC minutes and CPI numbers.

On the

macro side:

Last week, both unemployment numbers and NFP came in.

NFP were +263k in September, above the expected 250k, but below the previous

315k. The

unemployment rate dropped from 3.7% to 3.5%, but the participation rate dropped

by 0.1%. As we mentioned in the past, if the labour market holds steady the Fed

will keep pursuing the goal “to foster economic conditions that achieve both

stable prices and maximum sustainable employment”. In other words: it will keep

hiking until something breaks – regardless of whether this is on the demand

side or the supply side.

I am not

expecting a Fed pivot any time soon, and we are very likely to see another 2x

75bps on both Nov 2nd and Dec 14th meetings, going into 425-450bps target rate

by year end.

Financial

markets, and especially the FX and FI markets are very stressed, but equities

are surprisingly (?) holding up well.

1. ICE

BofA CCC & Lower US High Yield Index Option-Adjusted Spread rose to 12.32%

from 7.34% on January 2022, yet on March 2020 it was 17.79% and on March 2008

it was 36.7% (source: https://fred.stlouisfed.org/series/BAMLH0A3HYC# )

(chart 1:

CCC Spread)

2. ICE

BofA BB US High Yield Index Option-Adjusted Spread is still rather low ~3.21%,

but considering the uptrend and the debt structure of BB economies it is a

“quiet value” (source: https://fred.stlouisfed.org/series/BAMLH0A1HYBB )

(chart 2:

BB spread)

3. VIX is

at 32.45 and MOVE at 148.45 with the VVIX at 107.11 (both equities and bonds)

Derivatives

players are looking for both downside speculation and hedging. Nevertheless,

these indices move quickly and even if it is hard to time them, they report the

market fear.

(chart 3:

VIX and MOVE https://s3.tradingview.com/snapshots/n/NZ69XSzN.png)

4. US

mortgage rates keep rising:

a. 30-year Fixed 6.66% vs 3.098% on Jan 22

b. 15-year Fixed: 5.9% vs 2.43% on Jan22

c. 5/1 ARM: 5.36% vs 2.41 on Jan22

It makes

a huge difference to ask for loan to buy a house at 5.9% instead of 2.43%. In

dollar terms, a 15-year loan on $500k in January 2022 is equivalent to a loan

on 361k today. That’s a 27.8% decrease in purchasing power (excluding

inflation)! We might expect these discrepancies to weigh on house prices very

soon.

(chart 4:

US mortgage rates )

It is

hard to say if things are going to get worse or better from here, but I would

rather expect that many sectors will suffer more than others. The cascade effect

is hard to pre-test. But there is more pain out there.

TradFi

Equity indices are approaching pre-Covid levels:

1. SPX:

$3,612 vs. $3,385 before covid

2. NDQ: $10,926 vs. $9,718 before Covid

3. DJI: $29,202 vs. $29,537 before Covid

These

levels act as a magnet and breaking through them might dictate the next market

moves, also in the digital space.

Looking

ahead:

This week is once again all about the Fed:

1. Wednesday 8 pm CEST: FOMC Minutes Release

2. Thursday 2.30 pm CEST: CPI Release

Markets

are positioned as follows, and I am not expecting any sharp moves, unless

numbers are way worse or much better than the expected.

a. US CPI MoM: cons: 0.2%, prev: 0.1%

b. US CPI YoY: cons: 8.1%, prev: 8.3%

c. US Core CPI MoM: cons: 0.5%, prev: 0.6%

d. US Core CPI YoY: cons: 6.5%, prev: 6.3%

On the

crypto side:

Most digital assets are holding prices in tight ranges:

– $BTC: $19,051 (-3% WoW) and 30-day Realized Vol: 52.67% (bottom 15% last

360d)

– $ETH: $1,276 (-3.56% WoW) and 30-day Realized Vol: 76.15% (bottom 30% last

360d)

– $SOL: $31.44 (-4.41% WoW) and 30-day Realized Vol: 78.77% (bottom 5% last

360d)

Despite

being very volatile assets, volatility in general decreased as liquidity shrunk

and May fears seem to have passed (Terra-Luna, 3AC, Celsius, Voyager, etc.)

Also,

recently options market makers have been long gamma, and to hold delta-neutral

positions they were selling spot (and/or the future) on any uptick and buying

spot (and/or the future) on any downtick, thus compressing the volatility and

pushing down both the futures basis and the funding rates.

As a

reference, these have been the funding rates on FTX:

a. BTC 7d avg: -3.56% vs. 90d avg -2.28%

b. ETH 7d avg: -7.6% vs. 90d avg -11.72%

c. SOL 7d avg: -5.12% vs. 90d avg -7.39%

Currently,

BTC gamma exposure is approaching lower levels. While premia between the

implied volatility and realized volatility are tiny, as soon as the GEX

approaches zero or even negative territory, we may expect a pick-up in

volatility.

(Chart:

BTC GEX and ATM Implied Volatility)

Looking

at the spot chart:

BTCUSD is holding the XABCD pattern and if it approaches $17,500 (support), the

double bottom would then be tested. RSI is neutral and $20k is once again the

resistance.

https://s3.tradingview.com/snapshots/7/7enCty3o.png

Crypto maintained tight ranges last week as the macro outlook worsened, with BTC and Alts outperforming TradFi risk assets

Once again, the past week was slow, with tight liquidity. Looking ahead to this week, US non-farm payrolls data will be released (cons: 250k, prev: 315k), which will serve to help assess how Fed Policies are impacting the real market, and whether the Fed will slow down with its “Quantitative Tightening” programme.

Some macro events that I am following closely are the following:

- EU banking concerns (CS and DB)

- UK bond market and political actions

- Military developments in Ukraine

Liquidity scarcity is in my opinion one of the major issues that central banks are currently facing.

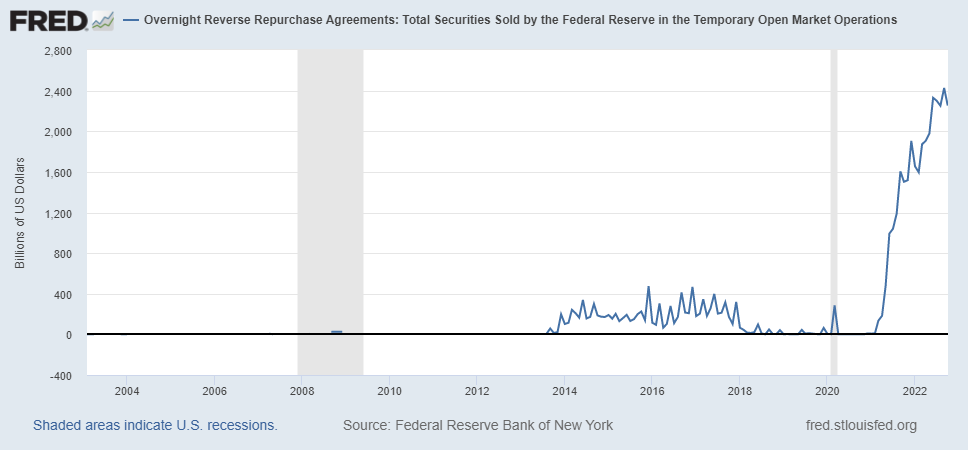

Indeed, the Fed balance has shrunk just a little. Looking at the Overnight Reverse Repurchase Facility (ON RRP), the billions of dollars that are literally parked there and getting 3.05% has skyrocketed.

Investors have $4.6 trillion stashed in US money market mutual funds, while ultra-short bond funds currently hold about $150 billion. And the pile is growing. Cash saw inflows of $30 billion in the week through Sept. 21st, according to figures from EPFR Global.

Investors have really few reasons to deploy capital into risky assets, even considering the high inflation.

Also, according to Fed data there are ANOTHER $18 trillion in deposits at US commercial banks, and US banks are sitting on more than $6 trillion of surplus liquidity, meaning that they do not know what to do with this cash as investing and loans do not look appealing. In 2008, with a completely different economy, surplus liquidity was $250 billion, some cash had been printed there…

Nevertheless, the spread between what banks are paying on deposits and what money market funds are offering is becoming wider and wider and is pushing the usage of RRP facilities even higher.

I somehow believe that a reduction in RRP counterparty caps could possibly be the most efficient method of encouraging a cash movement. As we move into a new state of the economy, with non-conventional monetary policies becoming conventional and public debt simply increasing, we might have both elevated RRP balances and reserve scarcity going forward.

Will things break at some point?

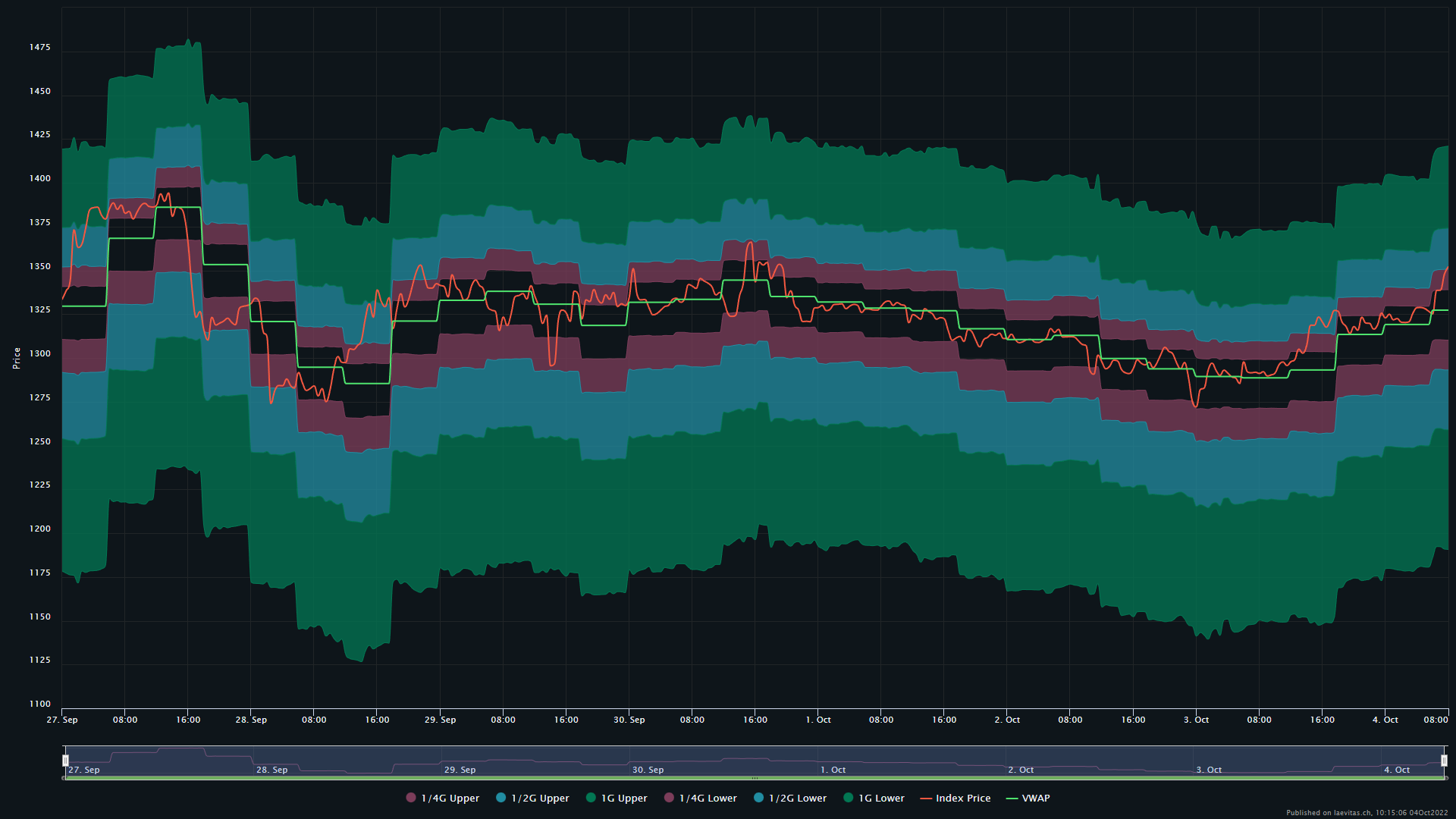

Looking at ETHUSD, we are now just above the $1,200 support. 30-day Realised Volatility is trading at 80%, and the 30-day ATM Implied Volatility is trading at 82%. As we are now trading around the median of the one-year historical volatility, a lower volatility is reasonable (i.e. around 70%).

Looking at the ETH Gamma Bands, we are now in the upper 1/2G, thus a short-term reversal is expected.

Nevertheless, support is $1200 and resistance at $1750