Investigating the collapses of Silvergate, Silicon Valley Bank, and Signature Bank and their effects on the industry.

Zurich – 24.03.2023 – The recent collapses of Silvergate Bank (SI), Silicon Valley Bank (SVB), and Signature Bank (SBNY), have wreaked havoc on financial markets. Silvergate and Signature were notorious for being “crypto-friendly” institutions, providing most of the digital asset industry’s participants with USD bank accounts. SVB, in addition to banking half of US start-ups, also held funds for many digital asset companies, including Circle, issuer of USDC, a $40bn market capitalised stablecoin. Now that all three banks have failed, the digital asset industry is left to operate in an environment which lacks proper on/off-ramps between fiat (particularly USD) and cryptocurrencies. Does the industry’s limited access to USD banking weaken it, or can it persevere without traditional banks by using alternative methods? This is what we aim to uncover in this analysis.

Silicon Valley Bank

From Crypto Finance AG’s published comments on the latest developments in the financial sector (13.03.2023)

“Due to the collapse of Silicon Valley Bank, the financial markets experienced high volatility and increased trading volumes over the past few days. The situation was precipitated by the sale of bonds at a loss, and a proposed capital raise that triggered systemic risk concerns within the markets. Initially, traditional financial markets were affected. However, the concerns soon spread to the digital asset market. Circle confirmed USD 3.3bn of exposure (8.25% of USD of 40bn in reserves) to SVB, raising concerns around the integrity of USDC, which resulted in a de-pegging of the currency from the USD.”

Timeline of events

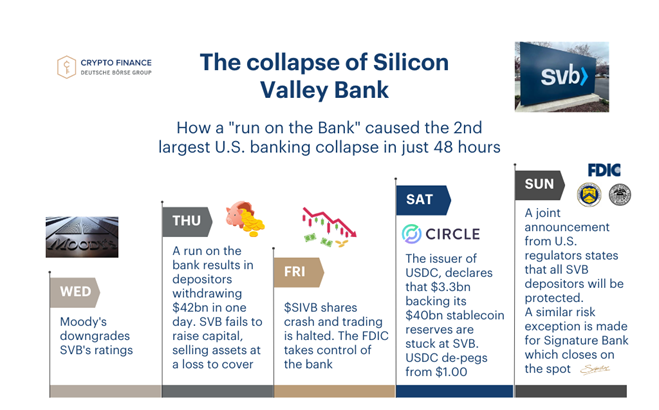

Figure 1. A comprehensive timeline of events that led to the collapse of SVB

- Wednesday 8th of March 2023: Moody’s Investors Service downgraded the ratings of SVB Financial Group and its bank subsidiary, SVB. Its long-term local currency bank deposit and issuer ratings were downgraded from Aa3 to A1 and from A3 to Baa1 respectively – link. This downgrade, in combination to the announcement of a proposed capital raise – link, which was not well received by stakeholders, spurred negative sentiment across depositors and investors. Early-stage rumours emerged about SVB’s health, instigating the bank run.

- Thursday 9th of March 2023: A significant bank run spread at SVB. The bank announced that because of customer withdrawals amounting to around $42bn (many start-ups were advised by their VC backers to take their funds out of the bank), they had incurred a loss of $1.8bn (after-tax) related to the sale of assets to cover cash withdrawals – link. This amount represented nearly a quarter of total customer deposits in the bank at the time. The failed attempt to raise capital, spurred more panic by depositors, contributing to an increased run on the bank and the crash in SVB’s stock price.

- Friday 10th of March 2023: As shares of SVB crashed, trading was halted, and the U.S Federal Deposit Insurance Corporation (FDIC) stepped in to take over the failing bank.

- Saturday 11th of March 2023: Circle (issuer of USDC) announced that they had $3.3B worth of funds which back the stablecoin, held, and now stuck, at SVB. USDC de-pegged from $1 to lows of around $0.87. Coinbase, the largest exchange in the U.S, also announced the pausing of their usual 1:1 conversion of USD to USDC – link.

- Sunday 12th of March 2023: The FDIC, the FED and the US Treasury released a joint statement in which they announced that they would enable the FDIC to complete its resolution of SVB, in a manner that fully protected all depositors. This statement was made to prevent a systematic banking failure in the US. In response, USDC nearly returned to its $1 peg, and the overall cryptocurrency market moved significantly to the upside. In addition, the three governing bodies ended their statement by declaring that Signature Bank was being closed on the spot by its state chartering authority, citing it had “a similar risk exception”.

- Monday 13th of March 2023: The cryptocurrency markets continued their move to the upside, while many banking stocks crashed at market open on Monday. Fears of a wider contagion across traditional banking, in the U.S. but also globally (e.g., Credit Suisse), sparked concerns within the financial markets. President Biden spoke at the White House about the U.S. banking system, making it clear that following the rescue of SVB and SBNY, “no losses will be borne by the taxpayers. The money will come from the fees that banks pay into the deposit insurance fund” – link. The collapse of both Silvergate and Signature led to complications across many OTC desks and exchanges concerning the settlement of fiat. New (or rather old) methods of settlement were explored, and the search for new banking providers for large digital asset-focussed institutions began.

Analysis

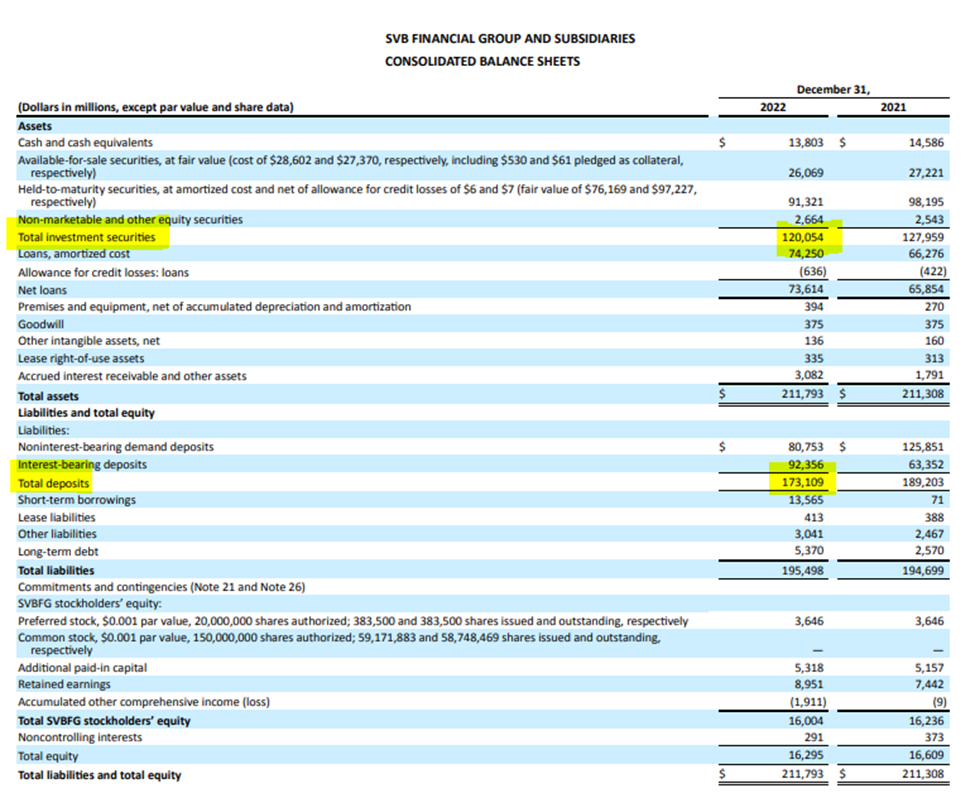

Before its failure, as of December 31st, 2022, SVB was the 18th largest bank in the US, holding over $200bn in assets, of which $120bn were securities, funded by over $170bn in deposits (see Figure 2). According to their own filings they claimed to bank nearly half of US venture-backed technology and life science companies in 2022. However, in a matter of 48 hours, SVB would face a major bank run and be forced into insolvency. On the 10th of March, the Department of Financial Protection and Innovation of the State of California declared that SVB had lost approximately $1.8bn from a sale of investments (US treasuries and mortgage-backed securities) two days prior. In addition, when the company announced it was conducting a capital raise, investors and depositors reacted by initiating withdrawals of $42bn in deposits, leading to a classic run on the bank. The federal authority completed its statement by mentioning that “despite attempts from the bank, with the assistance of regulators, to transfer collateral from various sources, it did not meet its cash letter with the Federal Reserve. The precipitous deposit withdrawal has caused the bank to be incapable of paying its obligations as they come due, and the bank is now insolvent” – link.

In the early hours of Saturday 11th of March, Circle, the issuer of USDC, the second largest stablecoin by market capitalisation, announced that $3.3bn of the approximately $40bn of USDC reserves remained stuck at SVB – link. SVB was one of six banking providers Circle used to manage the approximately 25% portion of USDC reserves held in cash. Circle’s other banking providers included BNY Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, Signature Bank, and Silvergate Bank (the two latter failing alongside SVB in 2023) – link. Following Circle’s announcement, the company’s stablecoin faced heavy redemptions, due to the concerns over its now-weakened reserves. This sparked a de-peg of USDC to under $0.90. Other stablecoins, such as DAI and FRAX similarly de-pegged, being themselves backed by a certain portion of USDC. The $3.3bn stuck in SVB represented around 7-8% of the total reserves of USDC.

The announcement made jointly between the FDIC, the FED and the US Treasury, on the 12th of March, was a powerful one, and was meant to prevent a systematic banking failure in the US and strengthen a fragilized economy. It seems like Circle had hoped that the FDIC would find a solution that protects 100% of customers’ assets, a couple of days prior in a company publication, showing this might have been the best outcome possible for the stablecoin issuer – link.

Figure 2. Balance sheet of SVB as of December 31, 2022

Silvergate Bank

From Crypto Finance AG’s published comments on the latest developments in the financial sector (13.03.2023)

“USDC’s importance as a settlement currency for digital assets for crypto institutions has been continuously increasing, especially since the recent collapse of Silvergate Bank (widely used as a crypto settlement bank), when the release of financial results was delayed post a withdrawal of USD 8bn in depositor funds. This increased dependence of the system on USDC could be observed since BUSD fell out of favour earlier this year by large institutional market participants.”

Silvergate started off as a Southern California regional bank, based out of La Jolla. They offered a traditional suite of personal and institutional banking services before pivoting to the digital asset industry in 2016. This business model transition was looking like a great success as they quickly became known as one of the most “crypto-friendly” banks, offering most major players in the space (exchanges, OTC brokers, hedge funds, etc.) with USD fiat bank accounts. This on/off-ramp which Silvergate offered was key to its success. They were publicly listed on the NYSE in November 2019 at around $15 a share. During the bull market of 2020-2021, $SI rose above $200, hitting an ATH at around $220.

The Silvergate Exchange Network (SEN), which allowed institutions to instantly move US dollars between crypto exchanges, OTC brokers and other players in the market 24/7 was the bank’s flagship service. The bank’s customer base grew from just 20 crypto-related customers in 2016 to more than 1,600 in 2022. Silvergate seemed to be thriving, but as the crypto markets turned red week after week in 2021, and many companies such as 3AC, Alameda, Celsius, FTX, and others (as previously covered by CFAG) went into liquidation or bankruptcy, the bank would eventually fall to its knees too. Silvergate’s clients started losing trust and its stock price began to crash, similar to the market capitalisation of the overall cryptocurrency market.

On the 5th of January, Silvergate published preliminary fourth quarter financial metrics – link. They announced that digital asset customers total deposits had declined from about $12bn to $3.8bn during the last few months. To “accommodate sustained lower deposit levels” the bank sold $5.2bn worth of debt securities, which resulted in an incurred loss of $718 million. To put this figure into perspective, Silvergate’s total net income from its previous seven years of business was around $170 million, or approximately a quarter of the net loss incurred in Q4 2022 alone.

Finding itself in such financial struggles, the company halted its flagship product SEN on March 3rd. Less than a week later, on March 8th, Silvergate announced it was proceeding with voluntary liquidation – link. And so, in the span of a couple of months, the most crypto-friendly bank would cease offering its services, and the industry finds itself with a gap left to fill.

Signature Bank

In parallel to taking control of SVB, the FDIC announced it was taking a similar approach with Signature Bank, which offered industry participants their own version of SEN, called SIGNET. The situation of Signature Bank was quite different to that of Silvergate and SVB. It held deposits totalling $89bn as of Wednesday 8th of March, of which less than 20%, or $16.5bn, were tied to the digital asset industry – link. On the 9th of March, they announced that around $10bn had left the bank – link. Stress was most definitely felt, but Signature did not face as strong of a bank run as Silvergate and SVB, and it seems like they were not “forced” to sell any securities at a loss in order to cover client withdrawals.

As of the day of writing it is still not clear why exactly Signature Bank was shut down. The New York Department of Financial Services referenced a “crisis of confidence in the bank’s leadership” as the main reason for regulators to step in. On the 16th of March, Reuters announced that bidders that were willing to take over Signature Bank would be able to do so only if they accepted to abandon all digital asset related business – link. A few days later, New York Community Bancorp announced it was taking over the bank’s non-crypto-related deposits, leaving the remaining $4bn in deposits from the digital asset business in limbo for now – link.

Outlook

From Crypto Finance AG’s published comments on the latest developments in the financial sector (13.03.2023)

“As a substitute for crypto settlement rails, the market has since fallen back on traditional banking channels. Currently, settling is done with counterparties in USD via banking rails, which results in longer than usual settlements for clients and counterparties. The actual settlement situation is changing fast, and Crypto Finance AG will provide continuous updates as market developments occur.”

No matter how much digital asset market participants want to operate separately from (and perhaps even compete with) traditional banks, the truth is that they need them. The US dollar is still trusted as a safe and stable fiat currency. Market participants settle trades in fiat, and therefore, banks that accept “crypto” companies as clients and offer fiat settlement services, are needed. Traditional banks represent the on/off-ramps which are necessary for anyone entering and exiting the digital asset space. Silvergate and Signature Bank were the two main banks serving the industry and acting as gateways between cryptocurrencies and US dollars. With their collapse, many market participants (centralised exchanges, OTC brokers, stablecoin issuers, etc.) which relied on them to convert cryptocurrency into fiat and vice-versa are left scrambling for alternatives.

Clearly, the failures of SVB, Silvergate, and Signature have had an impact on the digital asset industry. However, it is not so much that players have been affected financially, but rather operationally. The lack of instant USD settlement, previously supported by SEN and SIGNET, has forced the industry to revert to fiat settlement via wire transfers, a slower method that takes one to several days.

It is likely that incumbent banks may recognize that there is an opportunity in serving regulated digital asset-focussed institutions, and perhaps, they will become the “new Silvergate” or “new Signature” of the industry. Big names, such as JPMorgan, HSBC, and Citi Bank have recently been rumoured to be receptive to onboarding “crypto”-clients. As an example, New York Magazine’s Intelligencer has reported that JPMorgan is currently opening accounts for such institutions – link. It is widely known that the large US bank has been exploring the digital asset space, especially tokenisation, since at least 2020, when it launched its specialised arm Onyx.

If alternative US banks are to fill the gap left by Silvergate and Signature, the question around instant settlement (previously provided by SEN and SIGNET) is still to be answered. BCB Group, which is not a bank, but an FCA authorised payments institution, could potentially fill this void. Its BLINC network lets market participants move fiat 24/7/365, allowing for instant settlement. Still, BCB Group will need to rely on US banks to have access to dollar accounts and serve its clients efficiently.

Last, but not least, the digital asset industry in Europe could benefit from the US’s recent cut-off from traditional banking and continuous lack of regulatory clarity. To state the obvious, Europe is also suffering from traditional banking failures in the form of Credit Suisse, for example. But in general, when it comes to digital assets, regulatory clarity in Europe in the form of the soon-to-be-implemented MiCA, the Markets in Crypto-Assets Act, paints a stark contrast to the ambiguity in the US, where firms frequently face regulatory headwinds. This creates an increasingly challenging environment for the operations of any digital asset-focussed organisation. For new and existing market participants this is going to be a significant consideration, which Europe could benefit from.

It is intriguing to see how the industry will rebound post-Silvergate, Signature, and SVB. “New” banks will likely increase their footprint within the digital asset industry by serving “crypto”-clients, as the need for USD bank accounts is dire. There is no need to speculate about whether US regulators are trying to hurt the digital asset industry by forcing the closure of Signature, after the recent collapse of Silvergate. Conspiracy theories should be left aside and instead the industry should focus on maintaining high standards when it comes to risk management, compliance, and regulation. Scrutiny around this nascent industry is intensifying, but it seems more and more that players that manage to find the right formula to operate within the space, in a regulated manner, might just end up accruing the rewards.

Author:

William Ery, Partnerships Manager

Read more about the latest developments in the financial sector here.

About Crypto Finance Group

Crypto Finance Group – a prudentially FINMA-supervised financial institution and part of Deutsche Börse Group – offers professional digital asset solutions. This includes one of the first FINMA-approved securities firms with 24/7 brokerage services, custody, infrastructure, and tokenisation solutions for financial institutions. It also comprises the first FINMA-approved manager of collective assets for crypto assets, with a selection of crypto investment solutions, including the first FINMA-regulated crypto fund. With a team of over 120 employees, Crypto Finance Group is headquartered in Switzerland.

Partnerships contact:

Jakob Pedersen

Jakob.pedersen@cryptofinance.ch

Sales contact:

Stephanie Hurry

Press contact:

Jutta Holtkötter

Copyright © 2023 | Crypto Finance AG | All rights reserved.

All information in this communication is provided for general information purposes. No information provided in this communication constitutes or is intended as investment advice. This communication is not, and is not intended as, an offer, recommendation, or solicitation to invest in financial instruments including crypto assets. Investments in crypto assets are high-risk investments with the risk of total loss of the investment. You should not invest in crypto assets unless you understand and can bear the risks involved.

Crypto Finance is a financial group supervised by the Swiss Financial Market Supervisory Authority FINMA on a consolidated basis with Crypto Finance AG as securities firm and Crypto Finance (Asset Management) AG as asset manager for collective investments with the corresponding FINMA licences.

This communication and its content including any brand names, logos, designs, and trademarks and all related rights are the property of the Crypto Finance Group with Crypto Finance AG and its subsidiaries or third parties. They may not be reproduced or reused without their prior consent.