Bitcoin continues leading the crypto rally and retests $30k despite low volumes. This week CPI numbers will be released again.

Week-over-week performance:

- BTCUSD: 30,022, +6.75 %

- ETHUSD: 1,915, +5.16 %

- US02Y: 3.98%, +0 bps

- DXY: 102.30, +0.28%

- GOLD (USD/OZ): 2,000, +0.96%

- NDX: 13,051, -0.73%

- VIX: 18.96, +0.85%

- VVIX: 86, +2.38%

On the macro side:

The previous week’s US non-farm payroll numbers met expectations. This week, on Wednesday, the US consumer price index (CPI) numbers will be released. The year-over-year CPI expectation is 5.2%, down from the previous month’s 6%. The market seems to be prepared for numbers that match expectations, with the VIX (volatility index) below 20 and VVIX (volatility of volatility index) at 86. However, if the numbers deviate from what is expected, volatility is likely to increase.

On the crypto side:

Bitcoin has been performing particularly well, retesting the $30k mark for the first time since June of last year. Despite this, trading volumes remain low, indicating that few are taking profits from the year-end low and new buyers are still hesitant to enter the market.

The Relative Strength Index (RSI) has reached the overbought zone at 70, indicating that momentum is nearing its peak. The 30-day rolling Beta and Correlation with the S&P 500 are at a 1-year low, hovering around 0. This suggests that bitcoin is currently viewed as either a “Monetary Alternative” or as “Digital Gold” rather than being closely tied to traditional stock market movements, and is helping driving price higher.

- Support: $28.2k

- Resistance: $32k

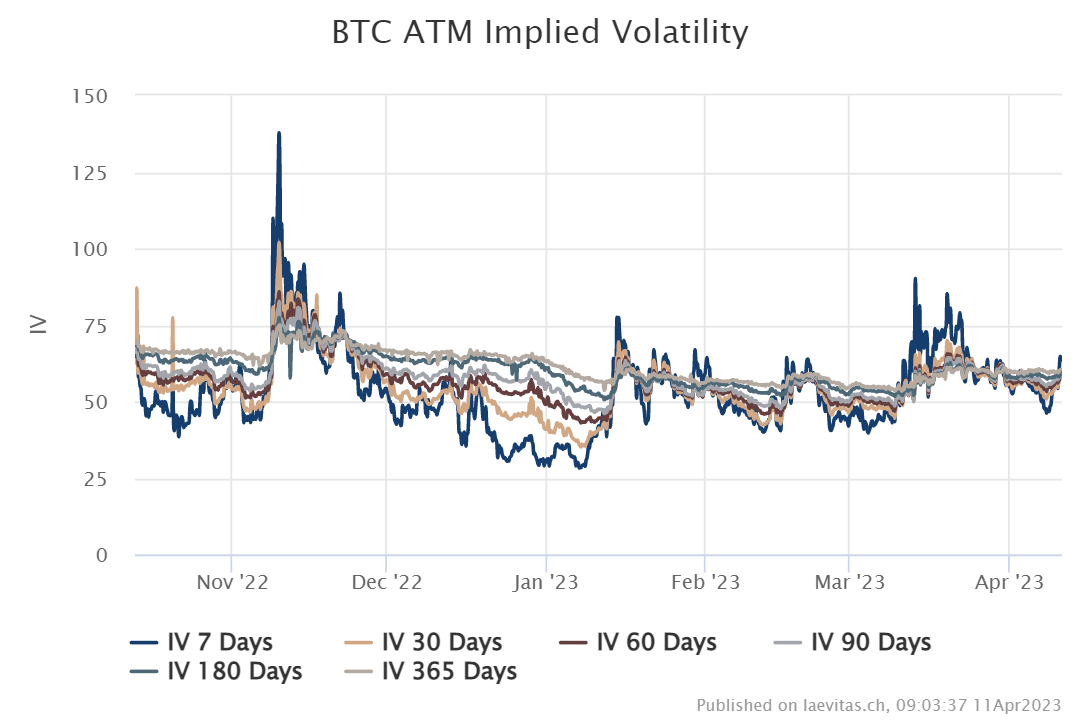

The ATM implied volatility for BTC is currently trading in the 60s, however, the 7-day realised volatility for bitcoin is currently trading at 36%, indicating that buyers are paying a significant volatility premium as they are expecting bigger price movements.

Chart 2: BTC ATM Implied Volatility

The skews, which measure the difference between the implied volatility of out-of-the-money call and put options, are in neutral territory. However, the 25-delta butterflies are becoming cheaper, with most of the wings trading in the bottom 25% of their tenor. Should the wings become more expensive, we could suddenly find ourselves in a high volatility environment.

Given the current situation, I remain biased towards extended grid-trading, but it is important to keep an eye on changes in volatility and the butterfly options in case the market shifts.

Read more News here