On the macro side:

I think we will see higher rates for extended periods, without any change in the Federal Reserve’s monetary policy. However, recent data from the US has indicated a robust labour market, and hourly wages came in lower than expected. This could lead to tension between governments and central banks, with central banks continuing to raise rates and governments increasing spending. Though I believe the economic effects of recent events have yet to fully manifest in the traditional economy, the crypto market has already been significantly impacted. We might see new lows, and new highs will take some time, but there is a big upside potential.

Looking ahead:

- Thursday, Jan 12th: Fed members speak and US CPI

- Friday, Jan 13th: inflation expectations

At the time of writing:

Spot:

- $BTC: 17,200 (+3.25% WoW)

- $ETH: 1,323 (+9.39% WoW)

- $SOL: 15.9 (+24.57% WoW)

Derivs:

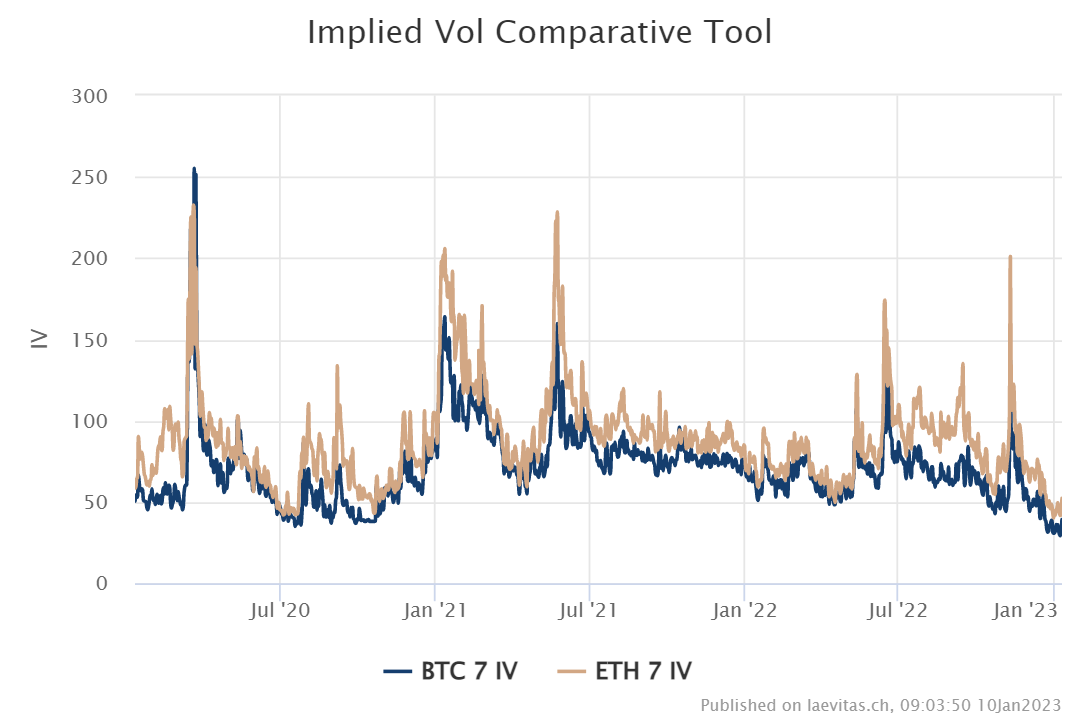

- Crypto Realised Vols continue being relatively low, with 1w BTC realised at 12v and ETH at 35v

- Implied vols keep being compressed and in a steep contango, with 1w BTC at 38v and ETH at 50v. With VRP at 20v+, selling volatility keeps being interesting. I believe that the current vol is also the result of low liquidity, once the volume picks up again, vol will follow. Also, given the events of this week, I would not be surprised to see front-end trading at 60v+ for BTC. Interesting here are the weekly options – which in the end are Gamma trades – and should the vol jump to the 60s, 10d will almost become the ATM.

Chart 1: Implied Volatility Comparison

- Front-end Skew is going into neutral territory, with 30-day BTC 25d Skew @ 3.39v and 30-day ETH 25d Skew @ 7.88. Since the spot prices have been moving range bounded, skews into the par value are an indication that future volatility could also come from bullish spot moves.

Looking at the charts:

- BTC: support @ 18,500 and resistance @ 15,500

- ETH: support @ 1,000 and resistance @ 1,350 first and @ 1,800

Read more News here